How to manage your finances is something that you don’t learn nearly as early as you should. Unfortunately, things aren’t always in one’s favor, as many people start off with a bad hand due to student debt that has accumulated before they started working. For others, simple yet costly lifestyle choices could be putting you under unnecessary financial strain. Luckily, there are some easy solutions to help you improve your finances. Find below 4 lesser-known ways to manage your finances.

- Budget and Reduce Monthly Bills

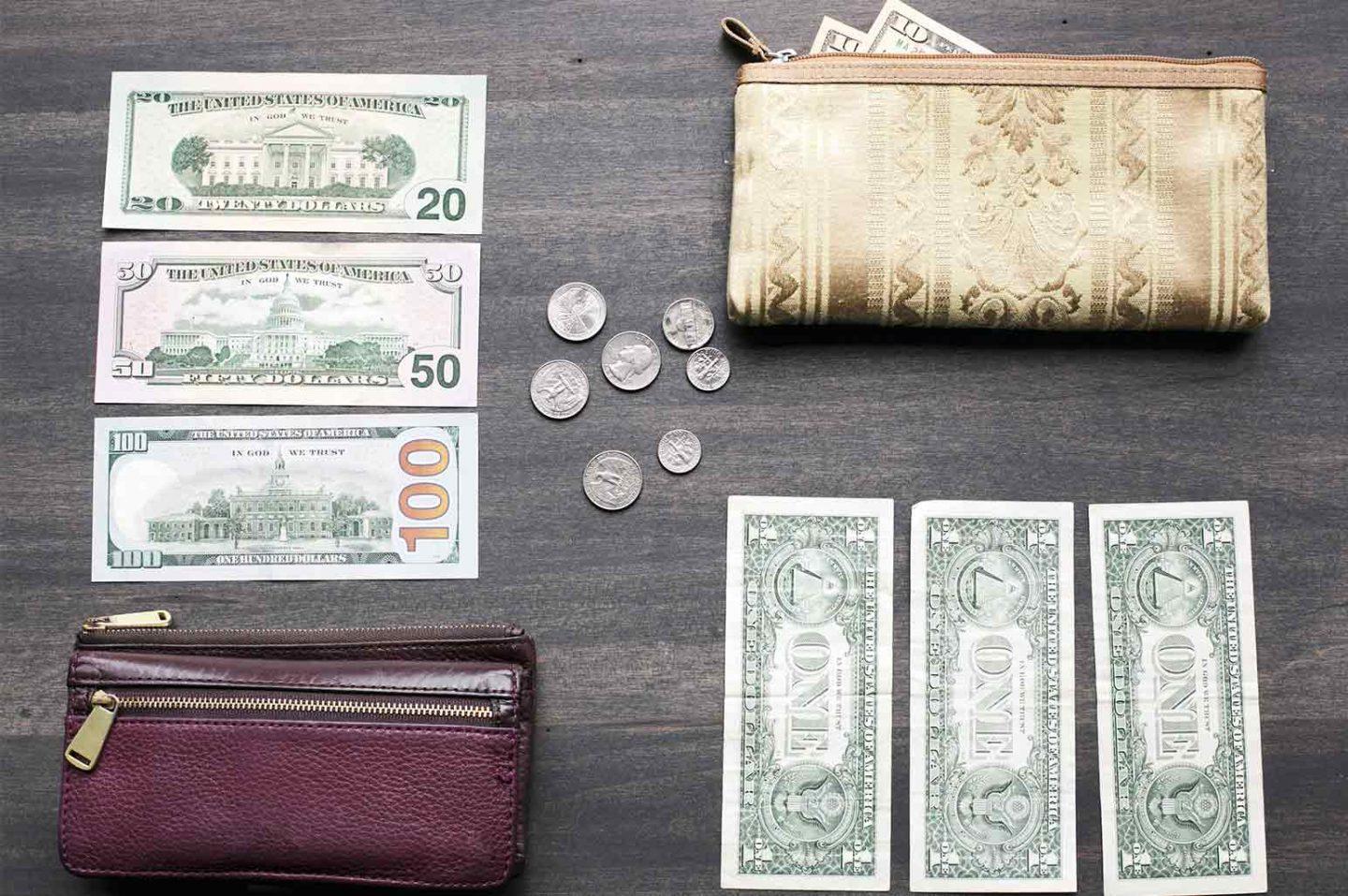

It sounds simple enough to reduce the amount of money you spend, but the reality is that it’s hard to change a lifestyle to which you’ve grown accustomed. What many people don’t know is that there are some simple ways you can improve the finances that allow you to continue living comfortably. To reduce your monthly expenses, you must start keeping track of your finances and ensure that every expense is accounted for. You’ll quickly start to see whether some expenses are reasonable or not.

Eating out eats much more of your money than necessary. Therefore, learning to cook your favorite meals will have a big impact on your financial stability. Today, loads of popular, restaurant-quality recipes are available for free with a Pinterest or Google search, and your weekly grocery store shopping expenses can probably be reduced by half if you have a meal plan set for the week. Check for coupons, discounts, and special offers. Conscious purchases and sticking to your shopping list will make a big difference.

Furthermore, you’ll notice that you can reduce your electric bill by switching to energy-efficient appliances and being more conscious of your choices. Don’t leave unnecessary lights on and don’t waste your HVAC’s effort by leaving doors open after cooling or heating a room. In fact, there are many simple solutions for reducing HVAC use, such as opening windows for a breeze in summer and letting sunlight in, rather than switching on the bulbs.

- Build an Emergency Fund and Savings

It’s vital to always set aside a specific amount of money from your salary each month. These savings are necessary in case of an emergency or to put towards your retirement fund. Either way, you always want to be prepared, so it doesn’t matter whether the amount is big or small, a little goes a long way to start building your savings. As your finances improve you can increase the amount of money you put towards your emergency fund.

- Pay Off Debts

Getting into debt is the most impactful setback that you don’t ever want to have. Therefore, you need to set aside some savings each month to get out of debt completely. Of course, this is easier said than done, especially if you’re going through any type of financial struggle. You can consider taking out a loan as long as you devise a plan to become financially solvent and pay it off. You can consult a financial planner to help you and ensure you stay on track.

Debt puts people under a lot of stress and the struggle to pay bills on time can render someone depressed and/or in other ways negatively affect their quality of life. Without a solution, debt can lead to bigger problems. Unfortunately, many people who struggle to pay off their debt also have a bad credit score. That’s why it’s important to know that there are ways to get your finances in order by getting a loan, even if you have bad credit. Look into the best credit cards to build credit: these offer instant approval. Most of these credit cards require no annual fees, offer rewards, and have reasonable interest rates. Although these cards are quite basic, they will help you take control of your finances.

- Establish Financial Priorities

You must start scheduling progress reports to make sure you are sticking to your financial plan. This should be done with your partner or whoever resides in your home with you. Together, you must establish what your financial priorities are to make sure you agree on how to distribute your income. This should be included in your financial plan to help you pay off any debts, discuss what you both can contribute to the savings or emergency fund, and gain better insight into what you need to consider immediately and what bills can be paid off over time.

As stated above, with mindful spending habits and some simple lifestyle changes that you previously wouldn’t have thought of, you can turn your financial situation around. Furthermore, don’t hesitate to look for deals that help you regain financial stability. Refer to this guide to help you set a financial plan today.