As with all vehicles, motorcycles do come with some risk. So, like all vehicles, motorcycles come with their own need for insurance as well. Here, we’re going to look at all the basic motorcycle insurance information to make the process of getting it a little easier.

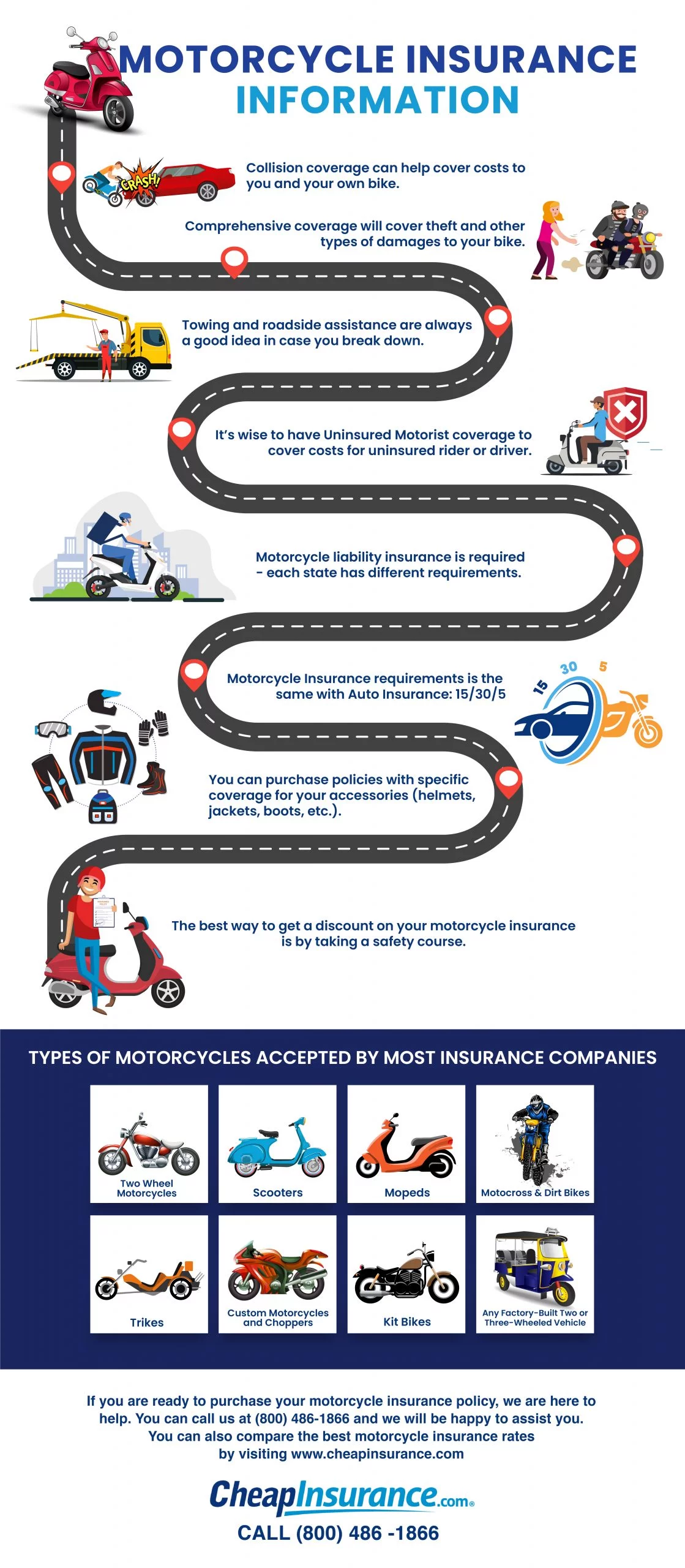

Because the risks of motorcycle accidents are typically higher than that of a car (since it’s harder for other drivers to see them), it is recommended that you consider more than just the minimum coverage. However, you want to manage your costs at the same time. Thankfully, motorcycle insurance companies offer a wide range of options to help you better customize the package that you get. This can include more coverage for property damage, bodily images, as well as adjustments to coverage amount for different kinds of costs. Similarly, you might want to consider getting towing and roadside assistance if you break down or additional levels of liability insurance.

While you want good coverage, you also want to make sure that you’re not paying out the nose for it. To that end, there are a few discounts that you might be able to manage on your motorcycle insurance. Safe rider discounts can help those with a proven track record of driving safely. You can get discounts by bundling your motorcycle with other vehicles or other insurance policies in general. Even belonging to a motorcycle-riding association can prove to insurance providers that you’re conscious enough about the risks to get some of the costs knocked off.

Infographic Design By Motorcycle Insurance Information